Student loan borrowers camp out in Supreme Court praising Biden’s forgiveness plan

The Supreme Court will hear oral arguments in two cases challenging President Joe Biden’s plan to forgive up to $20,000 in loan debt for millions of Americans.

Student loan borrowers camp out in Supreme Court

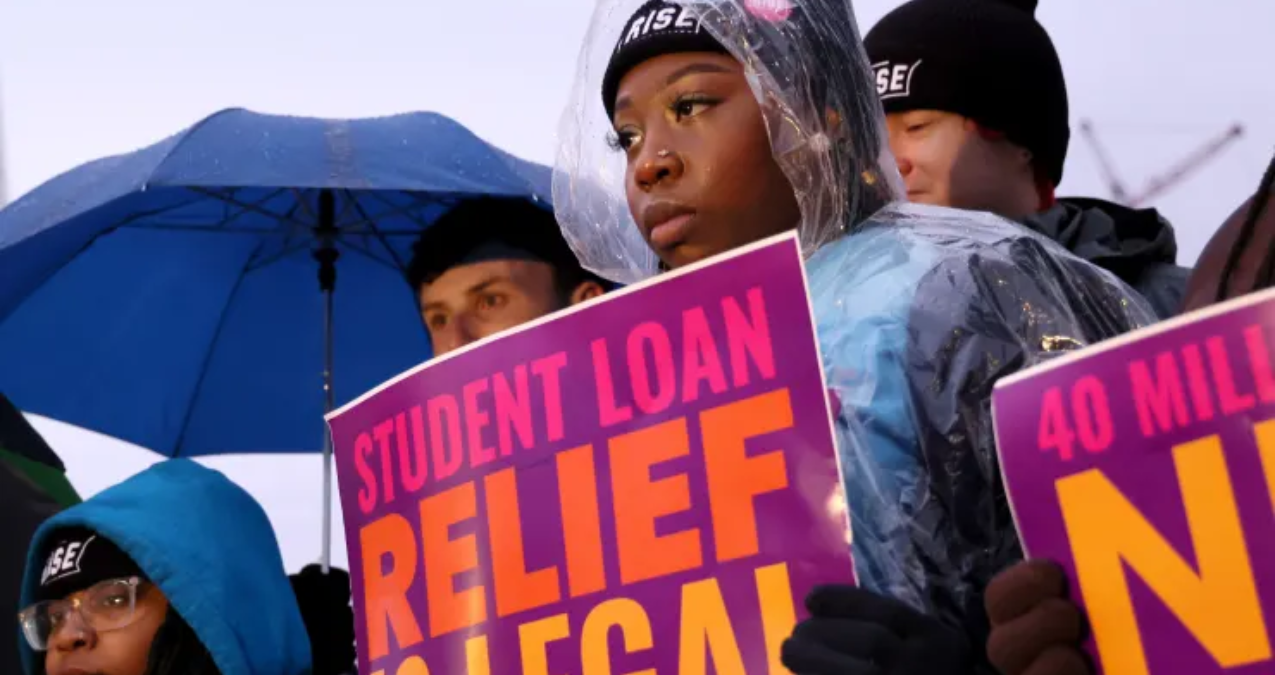

Borrowers gathered outside the Supreme Court on Monday to demonstrate in favor of the forgiveness.

A case was filed by the Republican attorneys general of six U.S. states.

The Biden administration argues that the Covid pandemic provides a legal basis for student debt forgiveness.

Experts say the court’s conservative majority will likely reject the plan if it concludes that the plaintiffs have standing to sue the federal government in the cases.

Student loan debt is a major problem in the United States, with millions of borrowers struggling to repay their loans. The total amount of student loan debt in the U.S. is over $1.7 trillion, and many borrowers have large balances that they must pay off over years or even decades.

President Joe Biden has proposed several measures to address the student loan debt crisis, including forgiveness of up to $10,000 in federal debt per student loan borrower. Some lawmakers and advocacy groups are calling for even broader debt forgiveness, such as forgiveness of all loan debt.

The issue of student loan forgiveness has been a hotly debated topic in recent years. Proponents argue that it would provide much-needed relief for struggling borrowers and boost the economy by freeing up funds that could be used for other purposes. Opponents, on the other hand, argue that it would be unfair to taxpayers, who would have to foot the bill for forgiveness, and that it would discourage future borrowers from taking responsibility for their debts.

Overall, the situation is complex and contentious, and it remains to be seen what action if any, will be taken to resolve the student loan crisis in the United States.

The court will hear two cases against forgiveness

Despite the cold, borrowers gathered outside the Supreme Court Monday to demonstrate in support of the Biden administration’s forbearance plan. More than 35 million borrowers could benefit from the policy and have up to $20,000 of their debt forgiven. If implemented, an estimated $400 billion in debt would be eliminated.

However, the program has been on hold since the fall, when a federal appeals court in St. Louis issued a preliminary injunction preventing the program from taking effect. The Supreme Court has stayed that injunction as it considers challenges to the plan, and the government stopped accepting applications for the program on its own in November.

The Supreme Court is hearing two separate cases Tuesday on President Joe Biden’s debt relief plan.

Student loan borrower John Runningen was also among those who tried to sleep in front of the Supreme Court Monday night. He attends Minnesota State Community and Technical College and owes $5,000.

That debt has already made his life more difficult.

“They’ve prevented me from buying a car, moving out of my parents’ house, and helping my parents deal with their bills,” said Running, 22.

As a first-generation college student, he hoped to break the cycle of poverty and support his parents. His stepfather is a farmer and his mother works at a gas station. However, with a monthly loan payment of $175, he won’t be able to help them.

“For some people, that may not be a lot of money, but for rural communities or those impacted by poverty, it’s the difference between being able to feed my family and being able to afford an electric bill,” Running said.

Within three weeks of opening the application process, the Biden administration reported that more than 26 million people had applied for the assistance and 16 million applications had been approved.

There is no precedent in U.S. history for the kind of sweeping debt relief the White House has promised, although consumer advocates point out that big companies and banks have been bailed out by the government after going through their own crises. And they say forgiveness of much of the education debt is necessary to provide relief to the many borrowers struggling with a broken credit system.