Shares of Tesla (TSLA) are rising Monday as the company prepares for its upcoming investor day on March 1. The stock jumped nearly 6% and was up 4.6% at 11:10 a.m. ET Monday morning.

Tesla Stock Jumped Monday

Tesla TSLA -0.92% Wednesday’s investor event could move the stock significantly. Traders are betting that the direction will be down.

Traders aren’t the only ones who think shares could be weak. Barclays analyst Dan Levy wrote Monday that he expects a sell-the-news event.

Levy is actually a Tesla (ticker: TSLA) bull and rates the stock a “buy,” with a $275 price target on the stock. The stock closed Monday at $207.63, up 5.5% and recovering from a loss of about 5% last week.

The S&P 500 and Nasdaq Composite rose 0.3% and 0.6%, respectively.

Levy expects Tesla to provide an update on its next-generation vehicle Wednesday, possibly a lower-cost car that could help the company grow in the coming years. Tesla vehicles cost about $55,000 on average, putting them in the luxury car range. A car costing $30,000 or less would give the company a much larger share of the global automotive market.

Still, the recent rise in the stock has Levy nervous. At the start of Monday’s trading session, the stock had gained about 60% year to date. It has risen 93% since its 52-week low of $101.81 per share on Jan. 6.

John Roque, senior managing director and head of the technical strategy at 22V Research, has a similar view. “I’d rather be a seller on any strength,” Roque says. “Again, I’d rather be a seller.”

Roque doesn’t make fundamental decisions. He looks at stock charts to gauge investor sentiment. When the stock slid last year, he correctly predicted it would find some support at about $100. He also saw Tesla stock meeting resistance at about $200 a share, which it did.

Support and resistance are terms technical analysts use to describe levels that stocks have difficulty going below or above. Support levels signal the level at which some investors are willing to buy a stock that is in a downtrend, while resistance indicates where they’re likely to take profits after a rally.

Tesla, of course, could surprise investors on the upside Wednesday. “If the news is well received, the first target would be the recent highs between $217 and $218,” says CappThesis founder and market technician Frank Cappelleri.

Stock charts, of course, can’t tell investors what the day will bring, points out Katie Stockton, founder of Fairlead Strategies. If Tesla fails to impress and the stock falls, she sees support near the 50-day moving average of around $157.

Based on Cappelleri and Stockton’s observations, the potential short-term gain appears to be about $20, while a loss of about $50 is possible.

Traders seem to believe that the balance between risks and potential gains means that stocks are likely to fall lower, and are betting that way. “In the last thirty days, we’ve seen 9.19 million short sales,” says Ihor Dusaniwsky, managing director at short-selling research firm S3 Partners.

Short selling is a bet that a company’s stock will fall. Of course, that hasn’t been the case lately. According to Dusaniwsky’s calculations, short sellers have lost about $7.3 billion betting against Tesla in 2023.

Calling the reaction to the event, or any event is little better than a coin toss. What investors can be sure of is that the stock will be volatile in the days and weeks following the analyst and investor meeting.

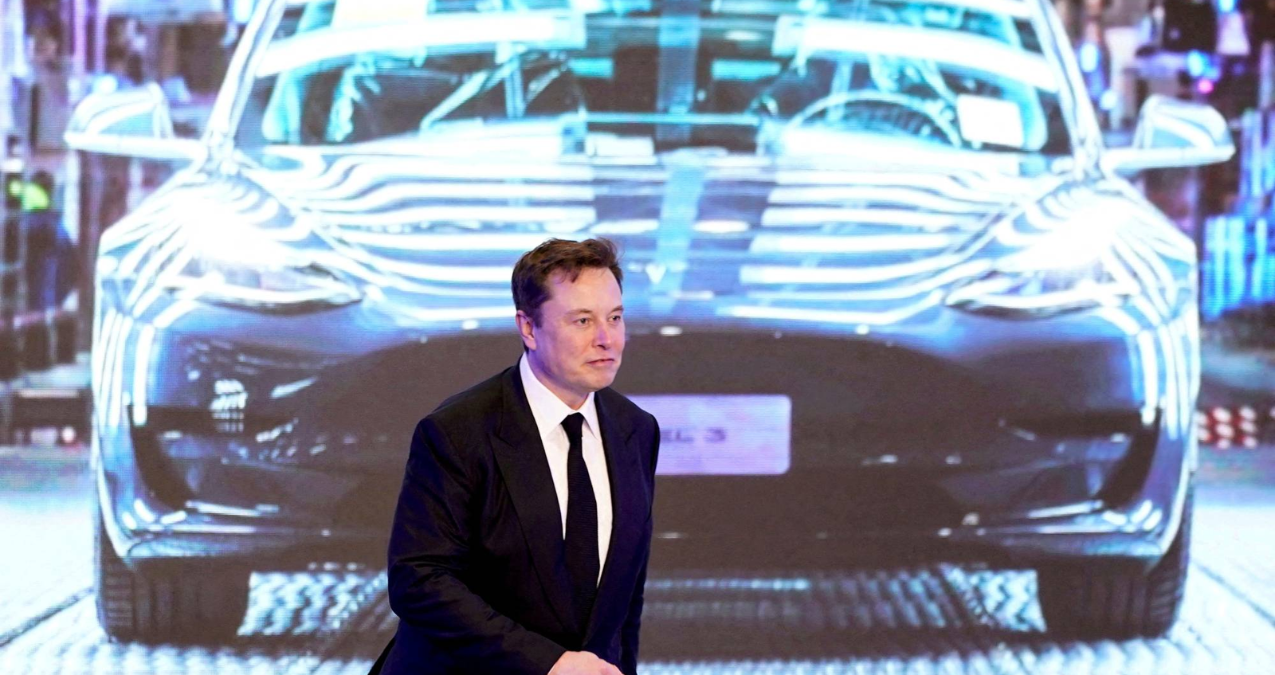

Tesla CEO Elon Musk World’s Richest Person

Elon Musk has returned to the top of the ranking of the richest people in the world. The rise in Tesla shares has led Musk to regain the crown he lost last year, but on paper, he still has a big loss to show for it.

will be moved by Tesla’s investor event

Tesla, the electric vehicle and renewable energy company founded by billionaire entrepreneur Elon Musk, has been one of the hottest stocks in the stock market over the past few years. However, Tesla’s stock has recently been experiencing a bit of a roller coaster ride, and the upcoming investor event is expected to move the stock market.

On March 9th, Tesla will be hosting its first-ever “AI Day,” an event focused on showcasing its advancements in artificial intelligence and machine learning technologies. This event is expected to attract a lot of attention from investors, as Tesla’s use of AI is seen as a key factor in its continued success.

However, there is some concern among investors that Tesla’s stock will fall as a result of the event. This is due in part to the fact that Tesla’s stock has been on a bit of a downward trend in recent weeks, with some analysts citing concerns about the company’s valuation and potential for competition in the electric vehicle space.

There are several factors that could contribute to a potential drop in Tesla’s stock price after the AI Day event. For one thing, there is a possibility that the event could fail to live up to expectations. Tesla has a history of hosting events that generate a lot of hype and excitement, but sometimes fail to deliver on the promises made.

Additionally, there is some concern that Tesla’s AI technology may not be as groundbreaking as some investors are hoping. While the company has made significant strides in this area in recent years, there is still a lot of competition in the AI space, and it is possible that Tesla’s technology may not be as advanced as some investors believe.

Finally, there is the issue of competition in the electric vehicle space. While Tesla has been a pioneer in this area, there are now several other companies that are starting to catch up, including traditional automakers like Ford and General Motors. This increased competition could put pressure on Tesla’s stock price, as investors start to worry about the company’s ability to maintain its market share.

Despite these concerns, there are also several reasons why Tesla’s stock could actually rise after the AI Day event. For one thing, Tesla has a proven track record of innovation and disruption, and the company’s use of AI is seen as a key factor in its continued success.

Additionally, there is a growing demand for electric vehicles and renewable energy, and Tesla is well-positioned to capitalize on this trend. The company has already established itself as a leader in this space, and its continued investment in AI and other technologies could help it maintain its dominance.

Finally, Tesla’s CEO Elon Musk is known for his ability to generate excitement and enthusiasm among investors and consumers alike. If Musk is able to deliver an impressive presentation at the AI Day event, it could help boost investor confidence in the company and drive up its stock price.

In the end, it is impossible to predict with certainty how Tesla’s stock will be affected by the AI Day event. However, it is clear that this event will be closely watched by investors and could have a significant impact on the company’s stock price.

If Tesla is able to deliver an impressive presentation and demonstrate that its AI technology is truly groundbreaking, it could help reassure investors and drive up the company’s stock price. However, if the event fails to live up to expectations or if there are concerns about Tesla’s ability to maintain its market share in the face of increased competition, we could see a drop in the company’s stock price.

Ultimately, the future of Tesla’s stock will depend on a variety of factors, including its ability to innovate and stay ahead of the competition, as well as broader trends in the electric vehicle and renewable energy markets. The AI Day event will be an important milestone in this journey, and investors will be watching closely to see how Tesla performs.

Tesla Stock Is Stuck. A Battery Deal Can’t Offset Weak China Sales.

Tesla TSLA -1.56% investors have had a busy week, and it’s only Tuesday. Before the main event of the week, an analyst day on Wednesday, investors have to digest news about batteries, demand for electric vehicles in China and new production capacity in Mexico.

First, Tesla (ticker: TSLA) signed a $2.9 billion deal for battery materials with L&F (066970. Korea), a Korean maker of battery cathode materials, according to a Google translation of a Korean announcement from L&F. The news sent L&F shares up nearly 9% and boosted the company’s market value by about $500 million to nearly $6 billion.